Learning how to invest is hard enough, but for even seasoned investors, investing during a recession isn’t easy. Watching stock prices absolutely plummet like they have been over the past few weeks isn’t fun, especially for those who have been in their stocks for a while before. For those of you who are looking to make your first investment, congratulations. This recession is allowing you to buy stocks at prices that haven’t been seen in years. For those who may have lost a considerable amount of money during this recession, that’s okay too. You too can buy into the market at lower prices than we’ve seen in years.

Whatever the case is, learning how to invest during a recession shouldn’t be scary. In fact, this may be one of the greatest investing opportunities in your life. However, knowing which companies to invest in and which to shy away from is important. Not all companies are going to recover from this, and it is important to stay away from the higher risks.

So, if you’re a beginner who wants to learn how to invest during a recession, you’re going to love this article. Here are some of the most important tips for learning how to invest during a recession.

Take Advantage of Blue Chips

If you’ve never heard of the term “blue chip,” I’m sure you still know these types of companies. Apple, Microsoft, Amazon, etc., are all blue-chip stocks. The main difference between blue chip stocks and other stocks is that blue-chip stocks are large companies that have a great reputation. Generally, these companies may not move a lot in price during regular market cycles. However, during a recession, they’re quite heavily “discounted.”

Let’s take Apple, for example. The company is down about 30% in price from its highest point during the time this article was written. This means that you’re able to purchase shares of Microsoft for 30% less than you would have been able to a month ago.

Read that again – 30% less.

This is why I call it a discount. For a company that is clearly strong and is very likely to recover from this pandemic and recession, you’re able to buy shares of these companies for far cheaper than you’ve been able to in a long time.

The issue is that young people generally like to take on more risk when it comes to investing. The fact of the matter is that we live in an age where everyone wants to get rich quick. To make matters worse, most high school and college students don’t have loads of money to invest. With only $1,000, you would have only been able to buy 3 shares of Apple about a month ago with only a little bit of money left over. Now, you can buy 4.

It doesn’t sound like much but believe me – it is. So many blue-chip stocks are at 52-week lows right now which is absolutely amazing.

However, like I said earlier, not every company is going to recover from this, and that does include some blue-chip stocks. Likely, there won’t be many large companies who are unable to recover, but it is possible.

If you’re brand new to investing and want a simple strategy for making your first investment, I highly recommend scooping up some shares of something like Apple or Microsoft. Large tech companies, in my opinion, are going to recover from this just fine. Apple will continue to pump out iPhones and Microsoft will continue with their operating systems. The key is finding companies who will continue normal operations and have enough cash on hand to make it through these tough times.

For those who have asked about the airline industry specifically, this could be a great opportunity to invest in them. I don’t think the same is true for the cruise industry, though.

Regarding airliners, it actually would not surprise me to see a few airlines to file for bankruptcy if this lasts as long as some of the experts say it will. However, companies who make airplanes, such as Boeing, are great options in my opinion.

For some of the larger airliners too, I highly doubt these will go out of business. But that doesn’t mean they can’t. That said, the prices of these stocks are so low that I find it hard to not take an opportunity if you’re okay with risk.

Don’t Invest in Penny Stocks

I feel like I don’t say this enough, but trading and investing are two totally different animals. I personally do both, but I realize a lot of people may not understand the difference.

Investing is solely done for long-term gains. When investing, you should be looking at companies that you want to be in for years on end. When it comes to trading, you may only be in the stock for a few weeks, a few days, or maybe even a few minutes.

During times of market instability, penny stocks are often flying off the walls. These may include tiny pharmaceutical companies that claim they have something in the work to fix the coronavirus, or small tech companies who gain traction because they drop news.

Going back to the point I mentioned earlier, everyone wants to get rich quick now. Seeing a penny stock jumping 150% overnight in valuation can be extremely tempting. Again, if you want to trade these companies on a short-term basis, be my guest. Also know that over 90% of traders lose money, though. It is a skill that has taken me years to learn and I still don’t consider myself an expert at it by any means.

But, please, DO NOT invest in these companies. While their news may look great, the chance that the company you’re investing in will be successful is minimal. To me, it is not in any way worth the risk. Again, you may see short-term gains, but the truth is that most of these companies do not care about their long-term success. Instead, they’re trying to get their stock price up to raise money or get out of their positions at a higher price.

Dollar Cost Averaging

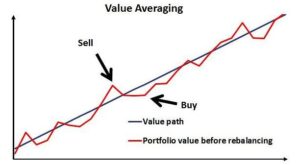

I’ve said it about a thousand times now, and I’ll say it again – USE DOLLAR COST AVERAGING. We really never know when the bottom of the market is going to come, and I personally think it’s going to go lower still. That does not mean that you should wait to start buying stocks.

However, it does mean that you should gradually buy in to reduce your risk.

Dollar cost averaging is exactly that. You set aside a certain amount of money every week or every month that you feel comfortable investing. Let’s say that you have $1,000 that you want to invest in total. Maybe every week you invest $100 at a time. That way, if the market keeps going lower, you’re continually getting better prices every week.

If the market goes up, don’t go all in. Continue to dollar cost average. The market will pull back even when it is going up and using dollar cost averaging allows you to take advantage of these pullbacks.

A lot of you have asked me if you’re supposed to dollar cost average on the same stock or if you should buy different companies every time. The beauty of dollar cost averaging is that if you see another opportunity (another stock) that you want to invest in, you can do it because you have money left over.

My personal recommendation would be to find a company that you have faith in and believe will recover long-term and build a position in that stock. However, that does not mean you have to do that. Maybe you find a couple of companies you want to invest in over time and switch it up every week. It’s really up to you.

DO NOT Invest Against the Market

While the market is falling, short-selling or buying into funds that go against the market can be very tempting. While trading these on a short-term basis is okay (if you know what you’re doing), please do not invest in these. You may some positive immediate results if the market continues to fall, but the fact of the matter is that the market will recover.

When the market does begin to recover, your position will go against you. If anything, buy into index and mutual funds that follow the market. Generally, these funds are made up of some of the larger companies on the market. Different funds have different groups of stocks that they are made up of.

For some more information on index and mutual funds, check out my article 3 Best Stock Market Investment Strategies for Beginners.

That article also serves as a great baseline for this article. When it comes to investing during any market, be it bull (going up) or bear (going down), you need to have an investment strategy. I really loved writing that article because I think that it covered some great strategies for beginner investors.

Also in that article, it talks about investing in dividend-paying companies. This may be a great time to begin investing in dividend stocks as well. Basically, what I’m saying is, go check out that article immediately if you have not yet.

Remember, You Don’t have to Invest in the Stock Market

I’m a huge fan of investing in yourself. Learning is earning in my opinion, and there’s no greater time to acquire an income-earning skillset during a time where unemployment is rising.

For me, I am a freelance writer. The beauty of that is that I have yet to have an issue finding work. Of course, many of you know that I write for Killer Papers, but I do other freelance writing as well. I will admit though, I paid for a few educational tools here and there when I first got started to help me excel at a faster rate than I would have.

The key here, is if you’re going to invest in an educational service, is to make sure it’s reputable. I understand that isn’t always easy to do, but the internet is great at finding out whether something is legitimate or not. Go on YouTube and search for some videos of the course or educational tool you want to buy and see what other people are saying about it.

Of course, there are going to be fake reviews on there, so use your judgement to see if they’re telling the truth. If the review seems scripted, it probably is.

Also know that investing in yourself doesn’t need to be strictly financial either. Just because you buy a course does not mean you will automatically succeed. When I first began writing, I wrote for free for 8 months before finally landing a gig. It took me a lot of time, but that was one of the greatest decisions of my life.

With so much free time on most of our hands, there’s no excuse that you don’t have enough time to learn another income-related skill. If you don’t have the means to invest in education, invest with time. Spend 6-8 hours a day working on a new craft that has the potential to make you money down the road.

If you want some ideas on side-hustles that you can begin working on to make you some extra money, be sure to check out my article Six Epic Side Hustles for Teens and College Students.

Be Smart

Guys, at the end of the day, investing during a recession isn’t too much different than investing in other markets. The only difference here is that you need to be careful of industries that may not recover from this virus. But when it comes to finding a company, I think the best piece of advice I can give you is focus on the big-name companies that are going to be around for years to come.

The price of stocks like Apple, Amazon, Google, etc., are lower than they’ve been in a long time. While it may not be flashy to get into these companies now, you’ll be thanking yourself in a few years.

Just remember that even though the price of these stocks are low, they very well may keep going down. But, by using dollar cost averaging, you’re allowing yourself to take advantage of the further price drops.

Be sure to stay tuned for my next article, which is going to talk about ways to make money online during a recession. I want to go more in-depth on how to take advantage of the internet to make extra money as unemployment continues to rise.

I hope this article taught you how invest during a recession if you’re a beginner. If any of y’all have any other recommendations or tips you want to hear, shoot me a message on Instagram, or hit me up on the contact page to send an email!