Finding stock market investment strategies for beginners isn’t always easy, especially for those who have never made an investment. For those who have never placed a trade or made an investment in the stock market before, the whole process can be daunting. You likely feel clueless and helpless when it comes to finding a stock to invest in, making the whole process that much more challenging.

Luckily, the whole process seems a lot scarier than it really is. Take it from myself, a 22-year-old who has been investing since I was 15. Through the years, I have learned how to pick stocks with long-term potential, as well as find some riskier ones that I think have the potential to explode.

That said, for the beginner investor like yourself, the best strategies are pretty basic. Until you learn a bit more about digging into companies and their filings (balance sheets and whatnot), there is no point in taking on such large risk.

As such, these stock market investment strategies for beginners are going to be pretty simple in nature. However, once you feel comfortable placing that first investment, it only gets easier. Later on, in future blog posts and podcasts, we’ll go more in-depth on how to find companies with more explosive potential (that are also a bit riskier).

Here are my 3 favorite stock market investment strategies for beginners:

Focus on the Big Names:

There’s no question that you all have heard of companies like Apple, Amazon, Microsoft, etc. These are among some of the largest and safest companies in the world when it comes to investing.

For that reason, these are some of the greatest names to invest in when it comes to a first-time investment.

However, the biggest question that people seem to ask is, “when do I buy these? They all seem like they’re up a lot.”

While that is quite true, there’s no real indication that these stocks are close to failing. Our economy is doing great, and I personally think we have a few more years of real economic strength; especially in the tech sector.

Another issue that a lot of beginner investors have, especially those without a lot of money to their name, is that these stocks are pretty expensive. Amazon, for example, costs upwards of $2,000 per share to purchase.

Unfortunately, you can’t purchase part of a share like you can with Bitcoin and other cryptocurrencies.

However, not all of the big-named companies are so expensive. Two of my favorite large companies to invest in are Microsoft and Apple. Historically, they both have performed great and are up massive on the year.

Some new investors go back to that “this seems too high to buy now” mentality, but the fact of the matter is that the tech industry is on fire as we speak. Until there is massive economic hardship, this is not something I would be worried about.

To find the largest companies in the world (by market capitalization), check out this list that is updated weekly. Find a company that you believe in and can afford a share or two in and place your first investment!

Interested in learning other lessons about the stock market? Check out my E-Book: 12 Investing Lessons, for other great stock market investment strategies for beginners. These are all lessons I wished I had learned in high school and college and have been a key part of my success in the stock market over the years.

Invest for Dividends

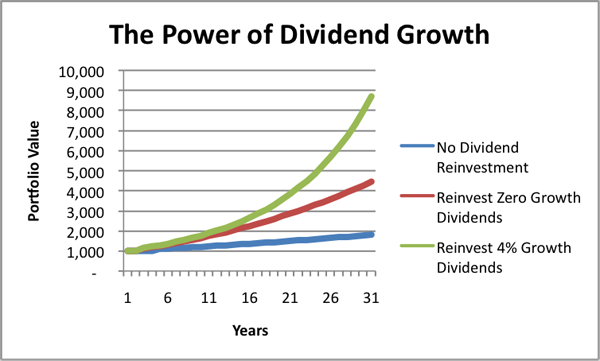

Dividend investing is one of my favorite stock market investment strategies for beginners. While you’re not going to make thousands of dollars on a small portfolio, you will be able to make some sort of passive income on top of the appreciation of a stock.

:max_bytes(150000):strip_icc()/dividends_shutterstock_458010730-51016c68a1854eccb1f1fafe091005f0.jpg)

For those of you who may be a little confused as to what dividend investing is, let me break it down simply for you. Many people invest in the stock market for the appreciation of stock price. This means that they make money when the price of the stock goes up.

For those investors who invest in companies for their dividends, the price of the stock only matters so much. What really matters are the scheduled payments the investors get paid simply for having an investment in the company.

What is a Dividend?

As for what a dividend actually is, it’s a sum of money paid on a scheduled basis to its investors from the profit the company makes. So, instead of reinvesting their profits into the company and its operations, the company invests its profits in the shareholders of the company.

The idea behind doing this is that investors will take those dividend payments and reinvest it into the company, especially if the company is doing well.

Also, this does not mean every bit of profit is given back to the shareholder. The company usually still keeps some of its profits to reinvest into the company to aid in their future growth. Some companies do this more than others. For example, Amazon is notorious for its aggressive growth strategy. Because of this, the company does not pay high dividends and instead puts its money directly back into the company.

In turn, that strategy generally results in a more exponential movement in the stock price (if the company is succeeding). They are able to grow at a much faster rate because they put a lot of money into growing their company.

Companies that pay their shareholder’s large dividends are not as worried about exponential growth. However, when an investor does reinvest their dividends into a company, this helps the company grow as well.

How Do I Know How Much the Dividend Pays Me?

This is one of the more common questions from beginner investors when it comes to dividend investing. Not every company pays the same amount of money.

Essentially, dividends are paid on a per-share basis. This is called their yield – you can find more information about yield and its meaning here.

For example, if a company pays a 1% dividend annually, they will pay the investor 1% of the value of the stock price every year (normally paid 0.25% quarterly), for every share they own. This means that if a company has a stock price of $1,000 and the shareholder collecting dividends has one share of the company, they will receive $10 per year from the dividend alone. Any upward movement in the stock price is just a bonus.

There are a few important points to note, though. The first is that obviously, the price of the stock could just as easily go down, meaning fewer dividend payments on top of losing money from the original investment. When the price of a strong dividend-paying company goes down, this is a great time to add more shares for more future dividend payments.

However, there are other riskier dividend-paying stocks who are very volatile. Sometimes, they pay such high dividends to their shareholders that they don’t have enough money to continue growing their business properly. As a result, the price of their share will continue to fall and may never recover.

Is There Such a Thing as Too High a Dividend?

This brings me to my next point – don’t pick a stock that pays too high of a dividend. If you do, there is a good chance the scenario I mentioned above could happen to you. Again, while it is great to pick a company that pays out high dividends, if it’s too high, the company simply won’t be able to fundamentally sustain themselves.

A general rule of thumb is that stocks that have dividend yields of over 10% are very risky. The reason for this is that the payout is considered unsustainable long-term or that investors are selling shares of the stock which will drive the price of the stock share down while increasing the dividend yield.

Still, dividend stocks are a great way to make money from doing nothing at all. My recommendation would be to find strong companies – ones you’ve heard of and know are good players in the long-term, and reinvest those dividends back into more shares, either of the same stock or another dividend-paying company.

Side note: there are also ETFs (funds, which will be talked about below) that pay dividends. Be sure to look into those options as well!

Invest in Mutual and Index Funds

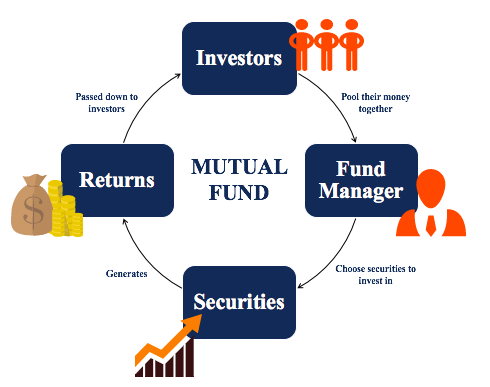

You’ve probably heard of these before but may not know exactly what they are. Before digging into the differences between an index and a mutual fund, I’ll give you a short run-down of what they are.

Funds are essentially an investment in multiple companies following a certain sector or index. These funds are also known as ETFs. Because these funds have large pools of money, your single investment of “x” dollars into either fund would give you an investment diversified into a number of different stocks. The best part is, you are not paying for each share of every stock it is invested in, but you are capturing (usually) the same percentage move.

For example, if a fund is invested in Apple, Microsoft, and Google, you now have a diversified portfolio after only having purchased one share of a fund. So, if Google drops by half a percent one day, but Apple and Microsoft perform well, you should still make money on that investment (in theory).

The Power of Diversification

In my opinion, the massive benefit that comes from diversifying your portfolio – in general, not just through the use of mutual/index funds – is that some stocks in your portfolio will have great days, and others will have off days. However, if you are invested in large companies with long-term potential, in the long run, your portfolio will continually increase despite some companies having off days in the market. As such, a diversified portfolio focuses less on day-to-day changes in stock prices.

Because mutual and index funds essentially capture the moves of these larger companies, it acts as a sort of diversification. To give you an example of what a fund investment looks like, check out the chart below:

As you see, it looks much like a stock chart. You purchase one share of the fund just like you would with a traditional stock, but that one stock is essentially invested in a number of different companies. The fund in the chart above is one of the most common index funds around – the Vanguard 500 Index Fund.

The Vanguard 500 Index Fund invests into the overall market index, meaning it generally follows the same movement of the overall stock market. There are other types of funds that may invest in very specific sectors that you find more appealing. To me, though, this is one of the least risky funds to invest in.

Difference Between a Mutual and Index Fund

With that description as to what these funds are, you may be wondering what the difference between a mutual and index fund is. Maybe you want to know if one is better than the other for investing for the first time. But at the end of the day, they’re both pretty similar.

The major difference between the two is that a mutual fund is actively managed by real people. This means that there are physical fund managers choosing which companies to invest in (that follow their fund) and when to invest. With an index fund, it is automated because it is meant to mirror the market exactly.

As such, it comes down to preference. When it comes to stock market investment strategies for beginners, there is no one that I would consider better than the other. I personally love the ability to have a choice in my investments, which is why I manage my own portfolio. Because of that, I think the idea of a mutual fund is a little more interesting and appealing to me. However, this is a personal preference.

There are Fees Involved

The only issue that comes about with a mutual fund is that there are slightly higher fees. Because there are physical fund managers choosing the stocks to invest in, your investment in that fund includes a slight fee to be paid to the fund managers. For some mutual funds, you may be paying 1-3% in fees, though, many reports show that the average fee for investing in a mutual fund is roughly 0.84%.

For an index fund, you are still going to be paying a fee. However, that fee is significantly lower, coming in around 0.07% on average.

If “high” fees are something you consider to be an issue, then the clear choice is an index fund. Fortunately, there are countless index funds, but it all comes down to finding one you like in terms of the index that it invests in.

Also, important to note is that both mutual funds and index funds may be investing in more than just stocks or overall indexes depending on which fund you choose. Some of them invest in assets such as bonds or other unique types of investments as well.

Regardless of which kind you choose, though, just know that index and mutual funds are great options because of the diversity they allow for a lower price. Instead of having to purchase an entire share of a large company like Amazon or Google, both priced in the $1000’s per share, you are able to purchase a share of a fund for much less while being partially invested in a number of companies.

BONUS TIP: Use Dollar-Cost Averaging

Heard of this before? If you’ve read one of my previous blog posts – 4 Best Ways to Invest $100 – you probably have seen this and may know what I’m talking about. In my opinion, this is a great addition to all of these stock market investment strategies for beginners.

However, I didn’t go too far in-depth when I talked about this in that post, so I figured this would be a great time to dig deeper.

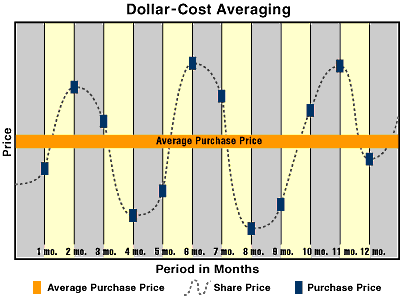

Dollar-Cost Averaging is a very basic investment strategy that emphasizes consistent investments at specified time periods. This gives a lot of wiggle room as to what you can invest in, but my recommendation would be to pick a stock or fund that you want to begin building a position in.

This is a great investment strategy for those of you who may not have a ton of money up front but work a job where you may get a couple of hundred dollars a week and want to invest a little bit of it every so often.

An Example of Dollar-Cost Averaging

Suppose you make $200 per week, which comes out to $800 per month. Of course, you’re not going to be able to invest that full $800 every single month, but perhaps you can swing $200 a month.

Next, let’s say you find a stock or a fund that interests you (one that is under $200 for a share).

Using Dollar Cost Averaging, you tell yourself that every month, you are going to put $200, or thereabout, into a stock.

For the purpose of this example, let’s now say the stock is valued at $50 per share during the first month. This allows you to buy four shares of the stock with your first $200 in the first month.

The next month, though, the price of the stock is now at $60. Unless you want to add an extra $40 for the month, you are now only able to buy three shares of the stock.

However, maybe the next month the stock is worth $40, meaning you are able to now purchase five shares.

For a better understanding of Dollar-Cost Averaging, check out this calculator. Plug in the values it asks for, and if you plan on investing in large companies or funds that follow the market, I’d recommend putting in 8-10% in for interest and 2% for the variance. Also, put in annually for compounding, since we are using 8-10% interest per year. This will show you the power of Dollar-Cost Averaging over the course of many years.

Time is on Your Side with DCA

The main idea here is that the price of the stock or the fund is always going to slightly vary, and by investing consistent amounts over multiple periods of time, you allow yourself to develop a position in the stock over time. While you may be paying higher prices during some investment periods and lower prices in others, your hope is to develop a better average cost than you would be to invest the entire sum of money at once.

Of course, if you pick a great stock, the idea is that as time goes on, the price of the stock will increase, meaning you would have been better off investing that lump sum up front. However, this fails to recognize two factors.

The first factor is that regardless, a stock price will always dip in some manner. That price may still be higher than when you first began investing in it but using Dollar-Cost Averaging allows you to identify the overall trend over the course of time and take advantage in those dips.

The other factor is that stocks are never guaranteed to go up. You may very well enter at the top of the stocks short-term move upwards at the very beginning – this is okay. Using Dollar-Cost Averaging, if the price goes down for a few months, you don’t have to try to guess the bottom price of the stock. Eventually, the price should rebound, and you can keep adding consistently to build up your position.

Why Dollar-Cost Averaging for Beginners?

One of the reasons that this is one of my favorite strategies for beginner investors is because it takes the emotion out of investing. Often times, the worst thing an investor or trader can do is overthink and place a trade out of emotion (or fail to take one).

Dollar-Cost Averaging “forces” the investor to take position regardless of whether or not the price is going up. In fact, you almost want to see the price go down to keep your average cost lower.

However, Dollar Cost Averaging should really only be used (for beginner investors) with large and reputable companies or funds. The reason for this is because these are the types of stocks that are likely to bounce back after large dips in the future. A smaller company may very well just continue to plummet, and it may not be worth adding to that position.

It’s All Up to You

It really doesn’t matter which of these stock market investment strategies for beginners that you choose. Whether you want to purchase shares of some of the largest companies in the world or invest in funds that diversify your portfolio, they’re all great options.

However, if you want to lower your risk in investing even further, be sure to try out Dollar-Cost Averaging. Compounding interest is on your side as well as consistently adding to your initial investments with outside money. Combining the two creates amazing long-term wealth, even with little starting money.

I’d love to know which beginner stock market investment strategy interested you most, so be sure to message me on Instagram or send me an email through the contact page of GoodStrongMen.com!

Liked this article? Check out other great finance and wealth-related blog posts on GoodStrongMen.com or listen to some of our upcoming podcasts! Feel free to reach out at any time with comments, questions, concerns, or recommendations for future content by hitting us up on our contact page today!